Blockchain Bridges: Unlocking the Power of Cross-chain Applications

In the last few years, the blockchain landscape has changed dramatically. Activity has migrated from one or two primary networks to multiple chains.

Binance Smart Chain, Terra, Avalanche, Solana, and Fantom are some of the leaders in usage and capital growth. By presenting a cheaper and faster alternative, these competing ecosystems managed to eat into the market share of Ethereum.

Total Value Locked of the ten most popular ecosystems 2020–2022

Network effects: onboarding new users

For these newer players, the question has been how to attract users.

Initially, pulling people in from centralized exchanges was a popular way, but soon the need came to start attracting capital from the ecosystem with the most, Ethereum. Enter bridges - a tool that lets you port information from one blockchain to another. Information such as contract calls, proofs, arbitrary data, etc.

Why would a user want to enter a new ecosystem?

Answers vary. But historically, it's due to lower transaction costs, curiosity about a new dApp, or more favorable yield farming conditions. Bridges have emerged to enable these desires, and in doing so, they provide an onramp for new users and capital into ecosystems.

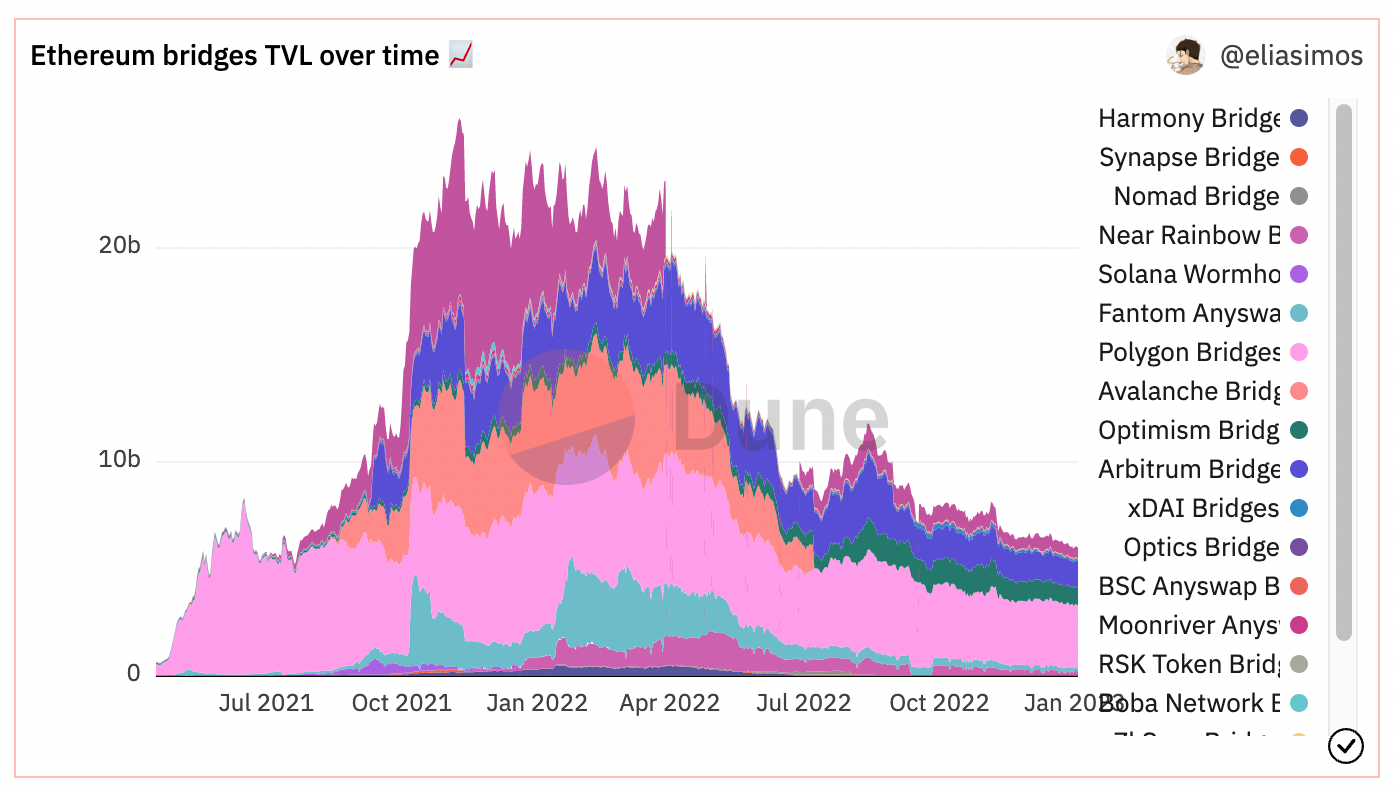

Below we can see the immense growth of bridges in terms of total value locked over the last few years.

Ecosystem incentives are behind most bridge volume

In the past, the majority of bridge activity was purely profit-driven. As an illustration, Avalanche announced a 180m liquidity incentive program in August 2021. At the time, the total value in the Avalanche blockchain was around 250m. After the announcement of the liquidity incentive program, the value on Avalanche reached 13 billion in December, a 52x increase.

There are many similar examples of "ecosystem catalysts" that draw in capital from elsewhere. But right now, the majority of this activity is DeFi power users allocating capital on protocols and decentralized exchanges (DEX).

That is, people chasing liquidity incentives, i.e., stake some tokens on my protocol, and you will receive some rewards. If done correctly, these rewards translate to a significant profit.

However, liquidity incentives have dried up in recent months amid market turbulence. And it's become clear that bridge growth must become driven by something other than "free money". Future bridge TVL growth must come from something more fundamental. This could be:

-

New ecosystems (L1s/L2s) that can attract users' interest.

-

New innovative cross-chain applications (DeFi, NFT, NFTfi, GameFi) can increase volumes under the hood.

The multi-chain protocols

Given the proliferation of new ecosystems and applications, many popular protocols in search of growth have deployed their applications and contracts to multiple ecosystems.

A few examples include:

-

Curve

-

Aave

-

Ribbon finance

-

Uniswap

-

Yearn

While it may be great that users can now, for example, use Aave on Polygon or Ethereum L2s, this has created many silos. The different entities of the same protocol in different chains are entirely separate applications from a user perspective.

The complexity of cross-chain activities

If a user wants to do something cross-chain, they're often faced with a complicated process.

For example, a user has deposited liquidity for a pair in a DEX on Ethereum but wants to move the liquidity to Polygon. To do this, they must unstake, remove the liquidity, approve and transfer both tokens through a bridge to Polygon, re-approve, and add liquidity to the new DEX, stake.

This is an expensive, slow, and error-prone process. We expect this to change, and when it becomes easier, the number of users will expand.

Questions around onboarding

Of course, this raises some questions about ecosystem growth, net new users, and where bridges fit into the bigger picture. For instance, should a network want to bring users and capital from other ecosystems that may not stick around once the incentive dries up or approach bootstrapping more from "scratch"?

The answer to this question starts with defining the top of the funnel. Most new users start at centralized exchanges, likely followed by Ethereum, Metamask, etc. Not on Near or Fantom from day one. So bringing in people from other ecosystems is one reason bridges are essential—particularly in a post-FTX world.

But they serve an even more important function that centralized exchanges cannot, cross-chain messaging.

From multi-chain to cross-chain

Going forward, we believe that bridges should be integrated into dApps and facilitate all complex cross-chain activities.

The upside for users is potentially huge. Not only will the bridge itself become invisible, but imagine if you could seamlessly:

-

Borrow funds from Aave on Polygon while the collateral is on Ethereum.

-

Use Yearn vault funds to keep farming on different chains without unstaking them.

-

Use a DEX aggregator that is sourcing liquidity for trades from many chains.

-

Market NFTs seamlessly in any ecosystem desired.

-

Interact with a DAO treasury on Ethereum from another chain.

-

Move funds between chains simply through a wallet.

To get there, we need bridges that are used less directionally, i.e., serve more of a function than onramp users and suck capital into an ecosystem.

We need multi-directional, decentralized infrastructure that enables cross-chain message passing and supports more complicated activity - calling a contract on another chain, composing things across multiple chains asynchronously, etc.

It's with these ideas in mind that we're contributing to Sygma, a modular, multi-directional blockchain bridging layer that allows data and value transfer between EVM-compatible blockchains and Substrate-based chains.

If you want to learn more about Sygma or if you have a comment or question, head over to our Discord👋

About ChainSafe

ChainSafe is a leading blockchain research and development firm specializing in infrastructure solutions for the decentralized web. Alongside client implementations for Ethereum, Polkadot, Filecoin, and Mina, we're building a portfolio of web3 products - Files, Storage, web3.unity, and more! As part of our mission to build innovative products for users and better tooling for developers, ChainSafe embodies an open source and community-oriented ethos. To learn more, click here.

ChainSafe is hiring

We're always looking for talented, ambitious people. Check out our open positions and get in touch ➡️ ➡️ careers@chainsafe.io

Website | Twitter | Linkedin | YouTube | GitHub

Acknowledgments

Co-authored by Colin Adams

Thanks to Megan Doyle, Tim ho, and Alex Mueller for their contributions to this article.